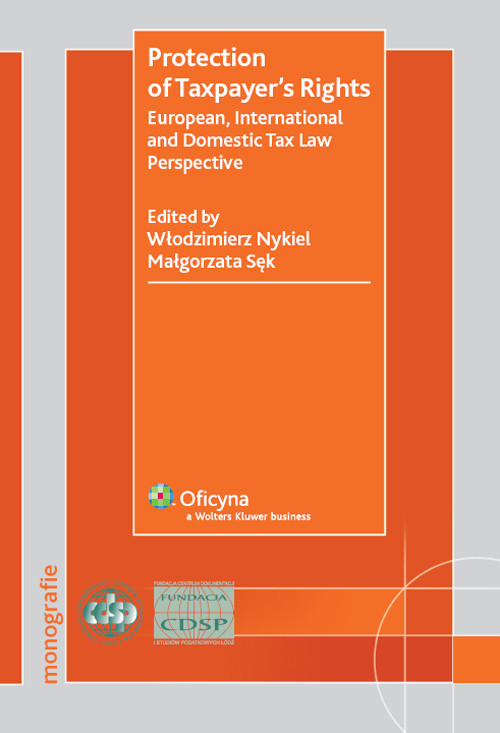

Protection of Taxpayer's Rights. European, International and Domestic Tax Law Perspective

Autor:

Nykiel Włodzimierz

Małgorzata Sęk

Wydawca:

Wolters Kluwer Polska

wysyłka: niedostępny

ISBN:

9788376018638

EAN:

9788376018638

oprawa:

Twarda

podtytuł:

European, International and Domestic Tax Law Perspective

format:

A5 (148 × 210 mm)

język:

angielski

Seria:

MONOGRAFIE

liczba stron:

412

rok wydania:

2009

(0) Sprawdź recenzje

28% rabatu

107,40 zł

Cena detaliczna:

149,60 zł

dodaj do schowka

koszty dostawy

Najniższa cena z ostatnich 30 dni: 107,70 zł

Opis produktuZasady bezpieczeństwa

This book is the result of an international conference on "Taxpayer Protection. Tax Policy" organized to celebrate the 10th anniversary of the Centre of Tax Documentation and Studies in Łódź, Poland. The conference was held on 9 and 10 May 2008 on the premises of the University of Łódź.

The book, like the first part of the conference, deals with the issue of the protection of taxpayer's rights from the perspective of European tax law, international tax law, as well as the domestic tax law of nine countries. The theory of taxpayer protection s also covered.

Following a theoretical introduction, the protection and enforcement of taxpayer's rights in European tax law is discussed, as well as the role of the European Court of Justice and the need for a European Court of Taxation. The European Convention on Human Rights and double tax treaties based on the OECD Model Convention are analysed as international instruments of taxpayer protection. The role of Bills/Charters of Taxpayers' Rights and Tax Ombudsmen is also discussed.

National reports, drawn up in accordance with uniform guidelines, provide a good basis for a comparison of various aspects of domestic tax systems which influence taxpayer's rights. Among other things, the following issues are discussed: the burden of proof in tax proceedings, administrative and judicial review of tax decisions, tax refund and private advance tax rulings. Moreover, the current national debates in the area of taxpayer?s rights protection are highlighted. Systematized comparative conclusions can be found in the general report of the conference, which also summarizes the fi ndings of the national reports

x

Uwaga!!!

Ten produkt jest zapowiedzią. Realizacja Twojego zamówienia ulegnie przez to wydłużeniu do czasu premiery tej pozycji. Czy chcesz dodać ten produkt do koszyka?

TAK

NIE

Wybierz wariant produktu

|